I like stories, I like listening to people tell stories and if you know me well then you know this is also how I like to communicate ideas.

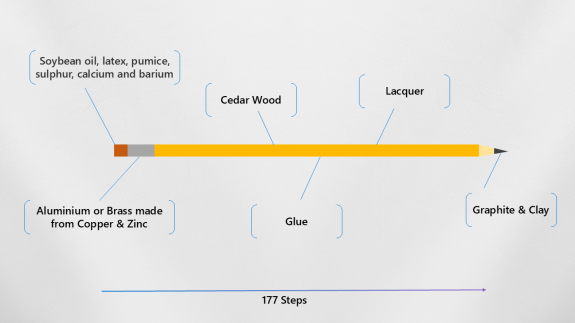

One of my most popular stories was the story of the pencil, I first told it about 10 years ago. I was inspired by something I heard about on an episode of a Freakonomics podcast which referenced an economic essay titled “I, pencil” I, Pencil – Wikipedia. It made me think about the relationship between simplicity and complexity.

My story is below:

This is quite obviously pencil. You know what it is and what it does. You don’t need a training program, a certification or a user guide to understand how to use a pencil. It is also simultaneously one of the most simple and yet most powerful devices on the planet.

Even today with all the technology available to us, children are still taught to read and write with the humble pencil.

If you think about some of the world’s greatest achievements, many of them probably started with a pencil. An idea, a sketch, many of the greatest artworks started with pencil drawing on canvas. Most business plans, books and inventions start with the pencil. And so at first glance we might think about the pencil as in fact a very simple device.

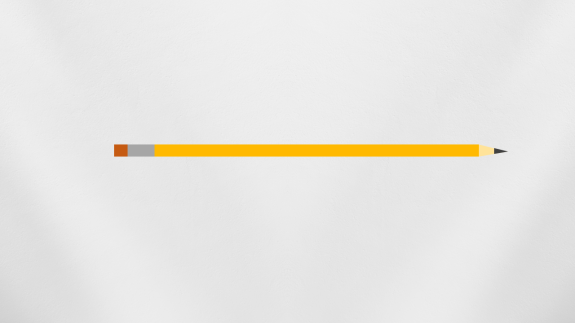

When I first thought about this story my daughter was still learning to spell. I think she was about five years old at the time. I remember she would come home from school most days with a list of ten words on a piece of paper. She would read each word, cover it with her hand and then she’d have to write out the word she had read. This would her homework each day (back when she liked doing homework). As somewhat of a competitive father, I thought I would test her a little 😊. So one day I got her homework and as she was halfway through I said “let me add something”. I took the pencil from her, and I wrote “I like Arsenal” on her homework page.

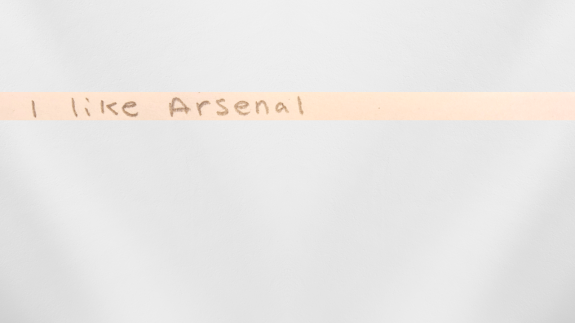

I gave her the page, she put the paper down and then took a pause.

You should know that I live in north London and although we are only around the corner from the Arsenal stadium you never know what might happen and who your children might support….

She said. “No Daddy, you are wrong……”

I was worried. I took a deep breath, and I wondered what was going to come next and this is, what she wrote:

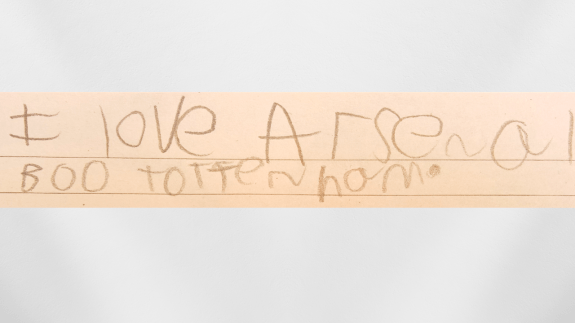

“I love Arsenal. Boo Tottenham”.

This was an incredible experience for me as an avid Arsenal fan and even prouder father! This was another example of an amazing experience of what can happen with a pencil.

The question then is:

“When you think about what your business, your solution, your value proposition. Do you look at the world through the eyes, of a child or user in terms of what amazing things you can do with a pencil? Or do you look at the world, through the eyes of engineer?”

Because if you look at the world through the eyes of an engineer, when you look at the pencil what you actually see are the different chemicals that are required to create the rubber, the different metals that are required to attach the rubber to the pencil itself. The cedar wood that is used to make the pencil (because cedar wood doesn’t warp). You need special glue to attach the two bits of cedar wood together. You need five different layers of lacquer to create that premium pencil feel. And then of course you need graphite and clay ( it’s the percentage of graphite and clay that determines the hardness and softness in a pencil).

And so suddenly we have gone from what would seemingly seem like a very simple device to something that is actually quite complex.

In fact in a manufacturing plant it takes over 177 steps to build the pencil!

Imaging buying a pencil. You go to the pencil shop, you don’t care about the different things that are in it, do you? You don’t care that it takes 177 steps. You might however be interested that this pencil was used by an artist that you liked or was used by someone who you admired.

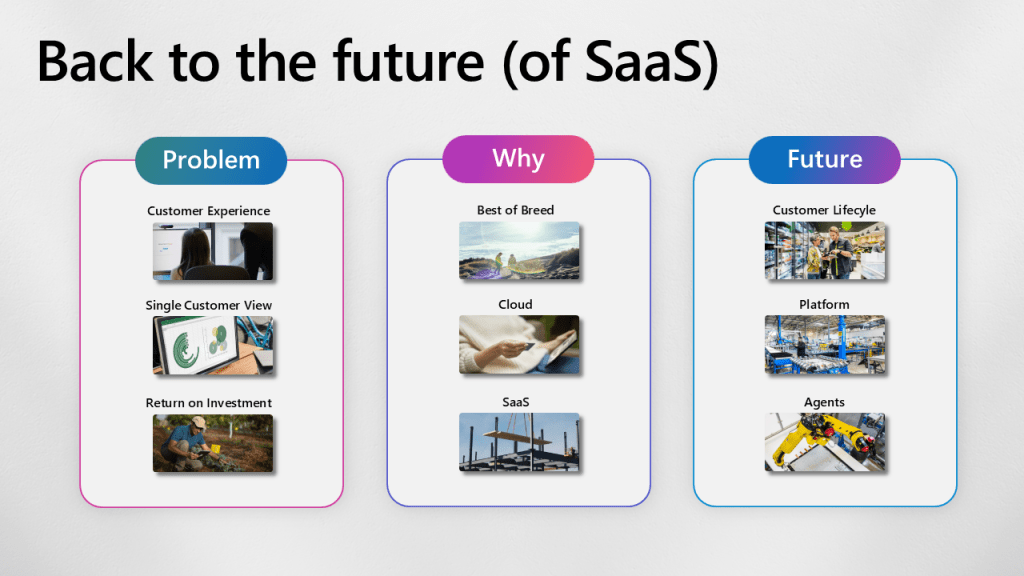

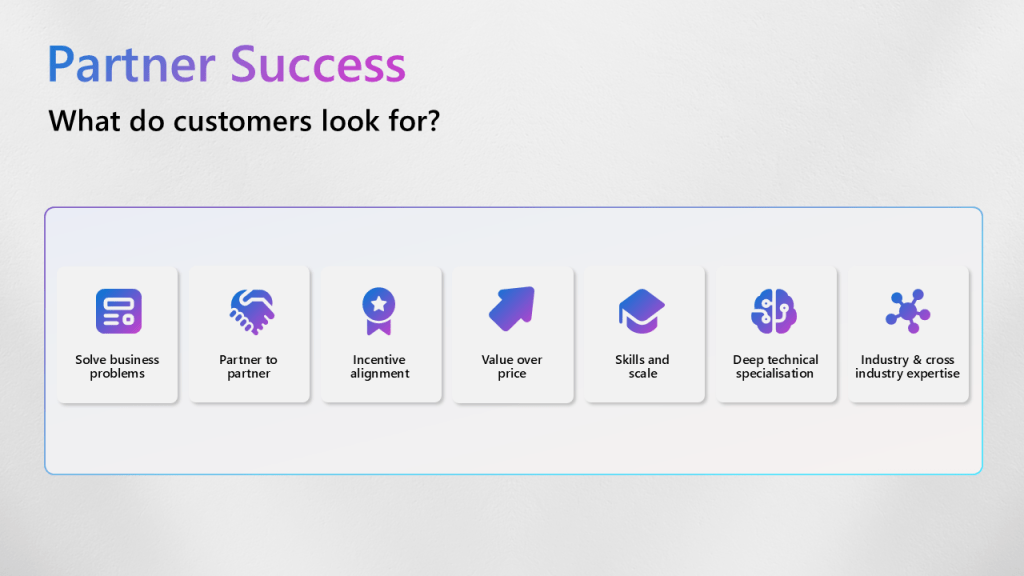

You certainly don’t really care about the complexity of the pencil itself. Often, I see organisations mistake complexity for differentiation. They may show a vast architecture slide to show the breadth of what they do in the hope that inspires some sense of uniqueness or something that other organisations might find difficult to replicate.

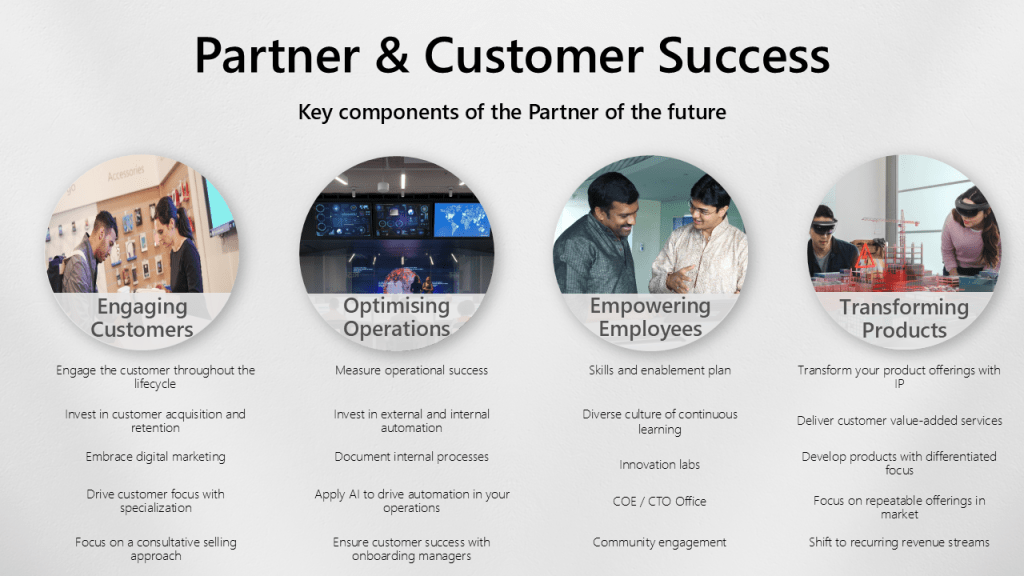

Successful organisations focus on what is possible and what the outcomes might be, this is who customers want to buy from.

Think about the pencil when you when you have a complex solution that you’re considering putting in front of a customer, ask yourself “what is it that I want them to see & experience?”.

Thank you for reading.